When family wealth transfers from one generation to the next, inheritors don’t necessarily keep the same advisors or want the same investments as their parents and grandparents. To retain continuity with families, wealth management firms need to strengthen their relationships with the younger generations before it’s too late, and ensure services are a good match for their potentially very different expectations.

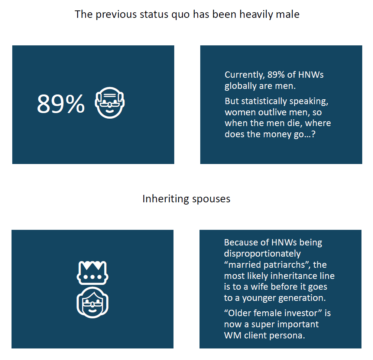

In the past, wealth has disproportionately been in the hands of older men. According to a GlobalData report published in August 2019, 89% of all global high net worth clients are men, and 38% are over 60.

But this is changing: over the next decade almost 20% of global HNW wealth (US$8.6 trillion) is expected to change hands and pass to younger generations. The wealth management sector faces seismic change in the near future, because new generation clients are more diverse and dissatisfied than ever before.

Are traditional wealth management firms and private banks prepared for this intergenerational transfer of wealth, and should they view it as a threat or an opportunity?

Does client loyalty breed complacency?

Historically, clients have tended to be very loyal to their wealth managers – just 6% of high net worth individuals change their primary wealth management advisor in any given year. For many firms, such stability has resulted in a business model that doesn’t necessarily account for new client acquisition, nor for the changing needs of future clients.

But research shows that when it comes to the transfer of wealth, client loyalty isn’t guaranteed: globally, only 24% of high net worth clients’ children have an account with the same firm, with 30% of UK next-generation inheritors moving their assets to a new advisor when they inherit their wealth.

This challenge reflects a multifaceted expectation gap between the generations. While the clients of today may be happy to receive much the same service they – and probably their parents and grandparents – have always received, this is unlikely to satisfy the clients of tomorrow. On the whole, we feel wealth management firms either fail to recognise the significance of this cultural change or, if stakeholders inside the organisation do recognise it, the organisation still tends to be making inadequate preparations considering the size of the potential impact on their business.

The threat from client demographics should be considered in combination with other major competitive pressures, including the impact of technology, ever-increasing numbers of new competitors entering the market, and increasingly risky and volatile market conditions. Wealth management firms cannot afford to be complacent. It is imperative that they adapt their business models to ensure they’re able to adequately serve these future clients, and through these improvements address other strategic needs such as digital efficiencies and stronger differentiation versus competitors.

Appreciating the generational difference

The new generations of inheritors are likely to have different expectations in three major dimensions:

- the type of information available to them and how it is communicated;

- the methods of delivery of investment services and advice;

- the investing strategies and deployment of their capital.

What’s at the heart of these shifts? According to GlobalData findings and our own CREALOGIX research, the new generations of high net worth clients – Generation X and Millennials – have very different lifestyle expectations to those of their parents.

The younger demographic is more likely to be globally mobile – high net worth individuals under 40 are twice as likely to live outside their country of birth. Younger investors are far more likely to be plugged into global trends, and tend to be self-educating about issues and opportunities beyond their own country’s borders. They are also less likely to be married, and are more likely to be concerned about diversity and equality.

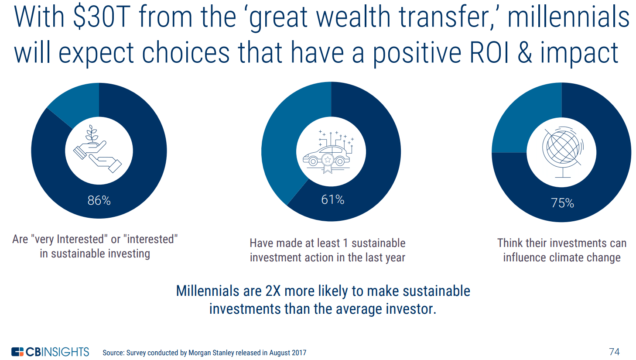

Finally, younger generations are overwhelmingly motivated by concerns about the environment and wider social issues: Millennials are twice as likely to make sustainable investments.

CB Insights: How Millennial Ethics Are Reshaping Fintech https://www.cbinsights.com/research/millennial-investment-ethics-fintech-2019/

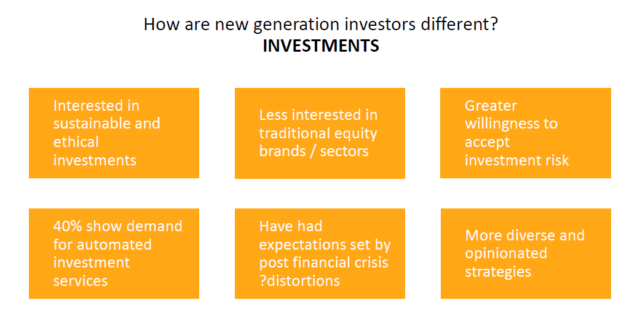

Millennials and Gen-Zs have grown up in the post-financial-crisis world and tend to be less interested in conventionally themed equity portfolios and more interested in investments which prioritise responsible, sustainable, and ethical themes. They have a greater willingness to accept investment risk and are often interested in a greater range of alternative asset types than older generations. A concern for control and choice in investments does not automatically translate into an appetite for active research and trading: the GlobalData research found that 40% of the younger generations are interested in automated investment services.

Looking at how new generation clients receive investment services, digital channels are a must-have. And as soon as services are delivered digitally, they become part of a wider digital lifestyle. Younger clients are influenced by social media, so wealth management firms need to be active and effective in these channels. Younger clients communicate through secure messaging tools far more than they do by voice – let alone wanting to arrange meetings or visit bricks and mortar stores: wealth management firms need to offer chat and messaging systems that match these standards. Finally, younger clients want advisors who understand them and demonstrate cultural fit with the firm: simply put, they will increasingly expect to deal with younger staff they can relate to.

Overall, younger generations consume services differently. In the same way that traditional service delivery has been disrupted throughout the high street, in retail, banking, holidays, insurance, and food – wealth management is next in line for a challenge to anything that looks stuck in a non-scalable, manual-human-process-dependent 20th Century model.

None of this should come as a surprise to wealth management firms. But the challenge in practice is about how to continue serving currently profitable but probably rather old-school clients, while rapidly putting in place new structures, processes, and products that prioritise the expectations of new generations, so that the firm is ready to promote these new services effectively to existing family clients.

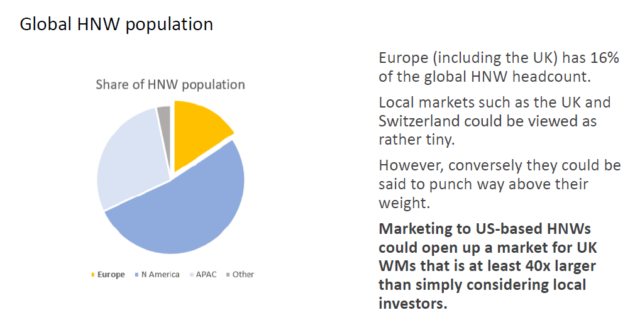

A major additional benefit of building new models that appeal to younger generations is that firms which can successfully exploit digital channels will be far more able to market themselves globally, potentially onboarding and servicing clients anywhere in the world. As well as addressing global English-language markets, the huge growth in second generation wealth in Asia and the Far East – often under-served by traditional local banks – this could be a golden opportunity for the strongest European wealth brands.

The female inheritor

While it’s clearly essential to cater to the different expectations of the younger generations, firms also need to ensure they are more active at addressing the specific needs of women.

Traditionally, wealth management clients have tended to be male, and indeed both male and female investors are consistently shown in surveys to characterise the wealth management industry as overly designed for men. It’s no good for a modern wealth management firm to accept that backward image, and the increasing importance of new generation investors only reinforces the urgency of change; high net worth individuals under 40 are twice as likely as those over 40 to be female.

It’s important to note that this is not just about Millennials. In terms of the intergenerational transfer of wealth, older women – as surviving spouses to high net worth men – are often the first to inherit family wealth. Indeed, the ‘older female investor’ is now a key wealth management persona for firms which take a more segmented approach to their client bases.

Can firms appeal to the female market if they are dominated by traditional male-oriented service assumptions, predominantly male advisors, and the resulting array of biases?

To better appeal to both older and younger female investors, firms may need to offer new types of conservative portfolio strategies, prioritise sustainable and ethical investments, and more directly address succession and legacy planning. Furthermore, they will need to make women more prominent in their marketing material, design less rigid and time-consuming advisory services, and appoint more representative advisory and governance staff.

The power of inheritance planning

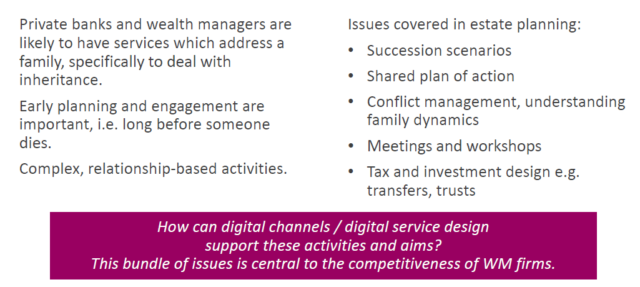

Wealth transition is a critical component of wealth management and most firms acknowledge the importance of inheritance planning. Over 80% of firms offer services relating to inheritance, and most regard building ties with the next generation as critical to client retention. Where firms already provide estate planning services and tools that aim to involve the next generations – such as succession scenario planning, conflict management, family meetings and workshops –are they offering these in ways that meet the needs and expectations of their potential future clients?

For example, these services tend to be offered via face-to-face, expert-driven and therefore jargon-heavy meetings with advisors providing limited upfront information, for significant fees. But the younger generations of families may be looking for something more. Among many other things, they will expect far more transparency and proof of added value.

To be better placed to engage with and retain future generations as clients, firms need to ensure they fully understand the dynamics of their current client families and build meaningful relationships with younger family members to understand their needs and aspirations.

Managing and building these relationships may involve something as simple as having family relationships mapped in a firm’s customer relationship management (CRM) system. Firms might also consider giving younger family members online access to financial reports and records of financial planning meetings, even if they don’t attend in person.

If they’re not already doing so, firms should be thinking about how to use digital channels and digital service design to support their estate and inheritance planning activities in order to remain competitive.

Digital and automation: threat or opportunity?

When it comes to the idea of depending on digital channels, generational differences are pronounced. For example, Generation X and Millennials are approximately two or more times more likely than their parents to want to use a virtual assistant, and to be adopt automatic saving options.

To meet their expectations, younger investors are turning to the ever-increasing number of challenger brands that provide this type of automated investment service: a quarter of high net worth Millennials have made use of a guided passive investing (“robo-advisory”) service, compared to less than 4% of the Baby Boomer generation.

Established firms are faced with a choice – continue to ignore this threat, or collaborate with technology partners and learn from innovative competitors and challengers.

Where next?

The global wealth management market is clearly changing, as are the ways in which wealth is transferred from generation to generation. To retain family wealth and appeal to a different demographic, traditional wealth management firms and private banks need to be able identify and engage with these future generations and develop products that are relevant to them.

Digital must be an essential part of this strategy, but it’s not to say the business model is going to become completely impersonal. Availability of expert advice remains important. Millennials tend to be honest about their lack of investment knowledge and are almost three times more likely than Baby Boomers to seek advice from a financial planner in an investment company. Digital services should facilitate access to advice, though for younger generations that does not necessarily mean the way their parents do it, i.e. sitting across a desk from an advisor with a folder of papers.

Many traditional firms already offer services that are critical to retaining intergenerational funds, but the key is to develop these services in ways that appeal to Generation X, Millennials and other young inheritors. This is perhaps where digital plays the most important role – developing an engaging and innovative client experience that reinforces the strength and stickiness of long-standing client relationships, rather than diminishing them.

The data and statistics quoted within this article were sourced from GlobalData’s August 2019 report: Intergenerational Wealth Transfer: Seizing the HNW Opportunity